Homeowners Insurance in and around Atlanta

Looking for homeowners insurance in Atlanta?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Sandy Springs

- Dunwoody

- Marietta

- Johns Creek

- Atlanta

With State Farm's Insurance, You Are Home

After a stressful day at work, there’s nothing better than coming home. Home is where you wind down, chill out and slow down. It’s where you build a life with the ones you love.

Looking for homeowners insurance in Atlanta?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Protect Your Home Sweet Home

Rodney Hunt will help you feel right at home by getting you set up with great insurance that fits your needs. State Farm's coverage for your home not only covers the structure of your home, but can also protect valuable items like your grandfather clock.

Don’t let the unexpected about your home make you unsettled! Reach out to State Farm Agent Rodney Hunt today and learn more about how you can meet your needs with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Rodney at (678) 999-8221 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.

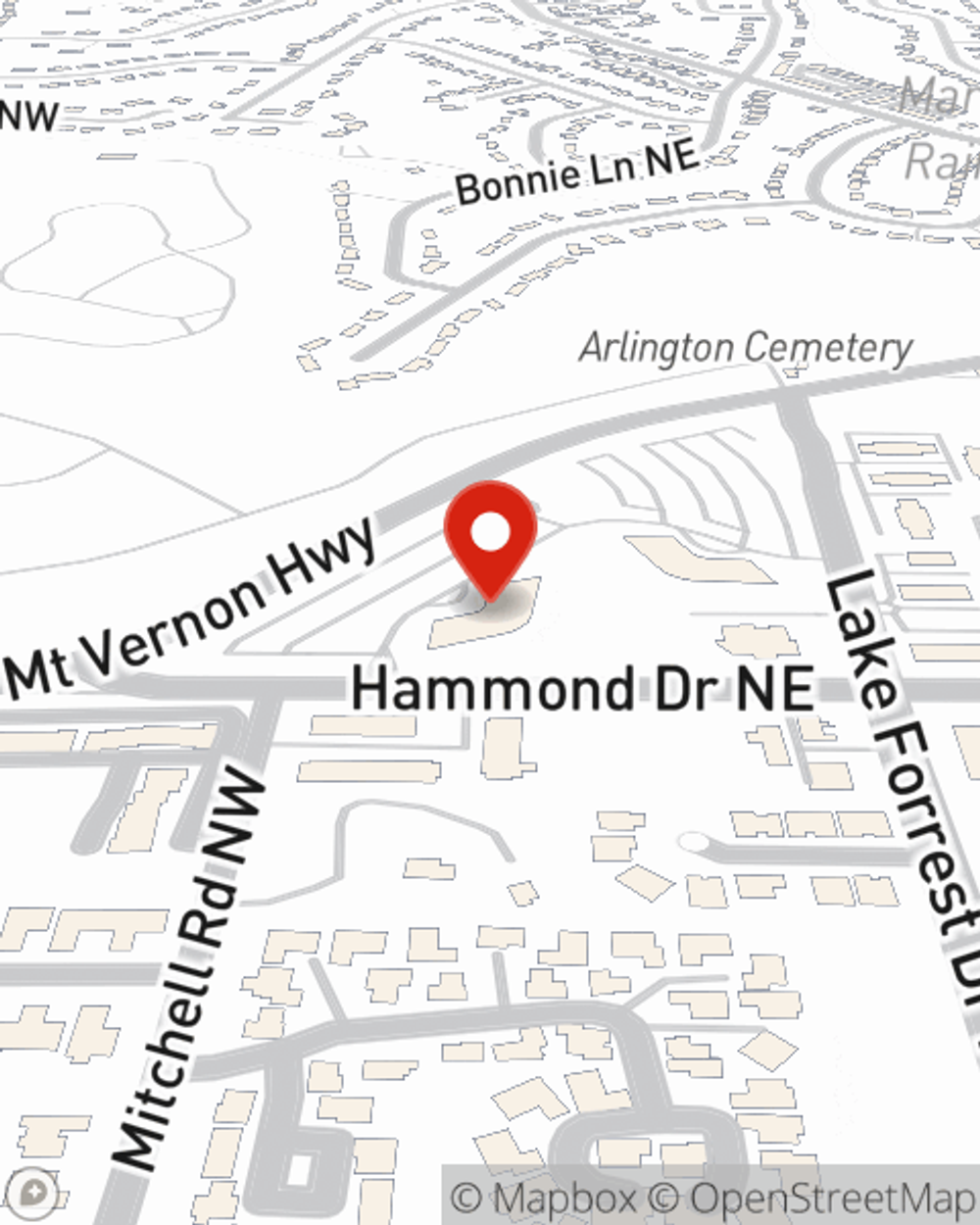

Rodney Hunt

State Farm® Insurance AgentSimple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.